In the face of the new coronavirus, China’s economy is more resilient than it was in 2003

SCMP | February 10 , 2020As the saying goes, “A thousand pieces of gold cannot buy one breath of life”.

Amid the coronavirus outbreak, Chinese policymakers have rightly prescribed a decisive course of action that puts health above all else. But good medicine often tastes bitter. Containment measures to stop the virus spreading, such as limiting travel and public gatherings, will inevitably have adverse side effects on the economy.

This economic pain is likely to be acute but short-lived. Some activity that is pent up this quarter will be released later in the year, helping the economy recover.

However, not knowing how long and severe the outbreak will be, it is impossible at this point to gauge the ultimate economic impact – not just on China, but the entire world.

If the virus continues to spread, it could endanger the fragile global economy, which was set for an upturn following signing of the phase-one US-China trade deal. Without prudent action, contagion effects and loss of confidence could ripple through global markets and supply chains.

Given the risks, timely global efforts are needed to stabilise the economy. In this regard, China is well placed to leverage its governance capabilities to mobilise a robust, full-team response to the crisis.

At the macro-level, China’s central bank has already given the economy a booster shot in the form of a 1.2 trillion yuan (US$174 billion) liquidity injection to shore up the economy and ease borrowing for companies. China Development Bank has said it is ready to issue bonds worth up to 13.5 billion yuan of bonds to fight the virus and its impact.

Targeted measures to inoculate the most vulnerable sectors, companies and workers are just as important. Smaller businesses that live on cash flow are especially susceptible to business interruption. Steps are needed to ensure this vital part of the economy can continue to function smoothly.

For example, cities such as Beijing and Suzhou have introduced policies to help small and medium-sized enterprises, such as deferred tax and social insurance payments, waiving of administrative fees, eased access to financing and rent reductions for those occupying state-owned land. There are also incentives for small businesses that retain and recruit more workers.

Consumers must also be protected. All too often, unscrupulous actors seek to profit from a crisis. China’s market regulator has vowed to punish those found guilty of price-gouging on essential products such as face masks. Steps should also be taken to ensure the steady supply of food and other vital goods.

Just how deep the economic fallout will be remains to be seen. Observers point out that the global economy stands to suffer more than during the severe acute respiratory syndrome outbreak in 2002, when China was primarily an exporter of cheaper products.

It is true that since then China’s economy has grown many times larger and is now an integral part of the global system. It is a key engine of growth entwined in complex value chains. The domestic economy is also more dependent on consumption and services, which are more exposed to the risk of a disease outbreak than the old export-dependent model. This reflects China’s development into a more mature economy over the last two decades.

Yet in other ways, China’s economy is much more resilient to viral damage than it was in 2002. Economic fundamentals are more sturdy. Having weathered storms and grown stronger, China now has a more developed “economic immune system” of structures and processes to deal with emergencies. This includes more effective policy levers, deeper resources and improved production and logistics capabilities.

Thanks to advances in technology and services, China’s economy is also more flexible than it was during Sars. This has allowed the economy to function amid steps to contain the new virus. Consumption has shifted to digital channels, with e-commerce, online education and streaming services picking up the slack as people avoid public places.

As businesses return to work, office collaboration tools such as DingTalk and WeChat Work have come into their own, allowing hundreds of millions to work remotely. Government and industry should cooperate to boost the role of these online remedies.

As the ripple effects of the virus become more apparent, it is not just China reaching into its policy toolbox to stabilise the economy. To soften the blow from reduced tourism, the Singapore Tourism Board is to waive licence fees for hotels, travel agents and guides. Thailand’s central bank has cut its policy rate to a historic low to ease the impact on Thailand’s tourism-dependent economy.

The proactive measures being adopted by other countries reflect the global nature of the challenge posed by the coronavirus, one that calls for all countries to work together. As United Nations Secretary General Antonio Guterres said, we should follow the advice of the World Health Organisation based on science and facts. Yet some countries are applying travel and trade bans that go against this scientific advice.

Not only do these blanket measures exacerbate economic harm for the countries involved, they can also discourage timely disclosure of virus cases and disrupt flows of information, expertise and vital supplies. Energy spent on such restrictions is better used for proven public health measures.

The coronavirus is a reminder that in our globalised world, we are all in the same boat and must work together to overcome transnational challenges. A concerted international policy response can help contain the virus and its economic fallout.

Closing the gates and discriminating against others will only create suspicion and enmity that can multiply across the world. In the face of common threats, it is perhaps division and prejudice that are the most dangerous pathogens of all.

Recommended Articles

-

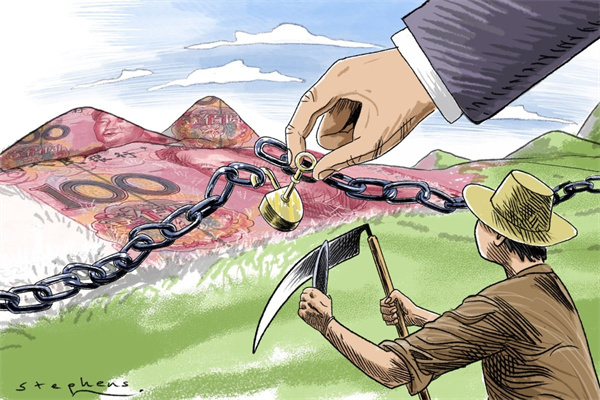

Wang Huiyao: How reforming rural land rights can aid common prosperity push

-

China still leading source of foreign students

-

Wang Huiyao: How restoring youth exchanges can build future bridges between China and US

-

China can serve as catalyst in Global North-South cooperation

-

China-EU cooperation needed to safeguard globalisation’s future