Wang Huiyao: RCEP’s synergy with China’s economic strategy bodes well for Asia-Pacific

SCMP | November 26 , 2020By Wang Huiyao | Founder of the Center for China and Globalization(CCG)

China’s plans to boost consumption will make it the RECP’s main import magnet, catalysing regional integration, even as RCEP membership opens doors to more trade deals for a reforming China

After eight years of tough negotiations, November 15 saw a breakthrough for regional cooperation as 15 Asia-Pacific nations signed the biggest free-trade deal in history. Comprising the 10 Asean members, Australia, China, Japan, New Zealand and South Korea, the Regional Comprehensive Economic Partnership (RCEP) will reduce trade barriers across a third of the world’s population and economic output area. Economists at Johns Hopkins University estimate the pact could add US$186 billion to the global economy – a welcome boost as we face the worst recession in a century.

Perhaps more significantly, the RCEP will catalyse Asia’s long-term integration and is a major milestone in the opening up of China, providing a foundation for membership in more advanced trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

In its 14th five-year plan (2021-2025), China must adapt to a post-pandemic world shaped by economic uncertainty and the splintering of global value chains. As China’s first multilateral trade deal – and the first to include Japan and South Korea – the RCEP, which will remove around 90 per cent of tariffs eventually, meshes powerfully with China’s dual circulation strategy, which aims to boost self-sufficiency while diversifying integration into global markets.

In “international circulation” – foreign trade and investment – the RCEP’s common rules of origin will make cross-border trade simpler and cheaper, allowing Chinese firms to optimise resource allocation between the domestic market and the rest of the region. RCEP membership will also anchor higher value-added growth points in China as multinationals shift some production processes to elsewhere in Asia due to rising mainland costs and a desire to insulate supply chains from trade frictions.

Links between China and RCEP supply-chain partners such as Vietnam and Malaysia are already deepening in sectors such as electronic manufacturing. China’s imports of integrated circuits from the Association of Southeast Asian Nations grew by 23.8 per cent in the first half of this year, while its exports of the same to Asean grew 29.1 per cent. Asean has surpassed the European Union to become China’s largest trading partner.

The RCEP also dovetails with China’s plans to internationalise the yuan and develop Hainan into the world’s largest free-trade port.

Just as importantly, the RCEP aligns with another core thrust of China’s dual circulation strategy: boosting domestic consumption.

The rise of the Chinese consumer is already one of the most promising growth stories for the post-pandemic world. In its 14th five-year plan, the Chinese government will further increase consumer spending by raising productivity and wages, strengthening the social safety net and expanding economic opportunities in smaller towns and rural areas.

Earlier this month, President Xi Jinping projected that China would import US$22 trillion of goods in the next decade. Firms, workers and farmers in RCEP economies are well-placed to tap this bounty.

China’s role as the RCEP’s main magnet for imports will offset its status as an export powerhouse, and help to balance trade dynamics within the pact. This is important as tensions could emerge if the RCEP were to seriously exacerbate trade deficits in member countries – a concern that saw India drop out of the agreement last year.

Over time, cross-border trade and investment will expand the synergies between China’s dual circulation strategy and the RCEP, reinforcing the pact’s cohesion and viability as a vehicle for deeper regional integration. Like fine wine, Asean agreements tend to improve with time.

For China, the RCEP could be a stepping stone for more trade agreements, as the Asia-Pacific becomes a coherent trading zone like Europe or North America, albeit on a grander scale.

For example, the RCEP boosts China’s prospects of sealing the trilateral free-trade agreement with Japan and South Korea that has been bogged down by spats between Seoul and Tokyo. It also weakens obstacles to China joining the CPTPP, an idea gaining traction among Beijing’s policymakers.

Previously, some voices at home had raised doubts over China joining the RCEP, let alone the less flexible CPTPP, seen as a forerunner of even higher-standard trade agreements. Success in the RCEP will help quell this domestic opposition while reforms take China’s economy closer to CPTPP rules on issues such as intellectual property, market access and foreign investment.

The two regional agreements are by no means mutually exclusive – seven countries are members of both. In fact, they could form complementary tracks to regional integration: the rigorous CPTPP for more advanced economies and the less-demanding RCEP for developing Asian countries. And China could eventually help to bridge the two projects – under the Free Trade Area of the Asia-Pacific or some other mechanism.

Given that US President-elect Joe Biden is open to renegotiating the pact his predecessor abandoned, the world’s two largest economies could one day come under its common umbrella of trade rules. Not only would this help to stabilise relations between China and the United States, it could also provide a template for World Trade Organisation reforms.

International trade and cooperation have suffered in recent years under the weight of populism, protectionism and now the pandemic. Encouraging news on vaccine development and Biden’s election victory have raised hopes that the world can turn a page in 2021. As a catalyst for Asian integration and China’s continued opening- up, the RCEP is yet another reason to be optimistic.

From SCMP,2020-11-26

Recommended Articles

-

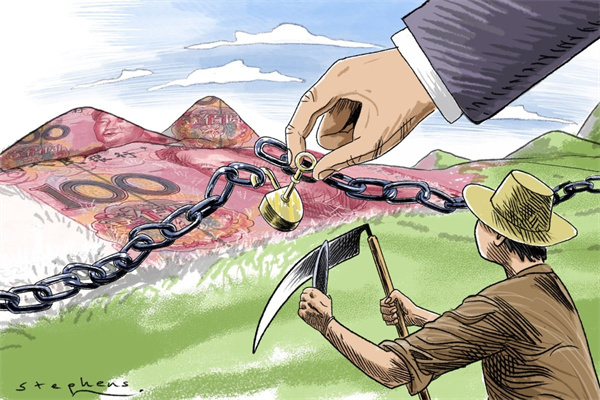

Wang Huiyao: How reforming rural land rights can aid common prosperity push

-

China still leading source of foreign students

-

Wang Huiyao: How restoring youth exchanges can build future bridges between China and US

-

China can serve as catalyst in Global North-South cooperation

-

China-EU cooperation needed to safeguard globalisation’s future